An Historic Change in Monetary Policy

�For many years, �good money� was tied to gold�giving holders of government issued pieces of paper some solace in that the gold behind the currency was there for them on demand. When the U.S. government, issuer of the world�s reserve currency since WWII, decided to abandon the gold standard, a new age of fiat currency around the world became the norm. During the 1970s, events such as the oil shock, pricing power of strong domestic corporations and associated strong labor unions, often supported by government deficit spending on indexed expenses unrestricted by reserves, contributed to double-digit inflation. In the absence of a gold standard and the double-digit inflation of the Seventies, the Federal Reserve defined its new role as guardian of stable prices. Prior to this change, the Fed targeted the growth in the money supply to achieve optimum economic growth with low inflation.

In early 1979, Paul Volcker assumed the chairmanship of the Federal Reserve. By December of 1980, the Fed had raised the Fed funds rate to 18.9% up from 10% when Volcker took over. It appeared as though the chairman was using high interest rates as the mechanism to lower inflation. Arthur Laffer, the supply side economist coined this new monetary policy the �price rule.� (Dr. Laffer is best known for the �Laffer Curve,� a graphic representation that 100% marginal tax rates meant virtually no one would work, and 0% tax rates meant that the government would collect virtually zero revenues. The Curve represented all other tax rates and varying levels of government revenues derived from those tax rates. The purpose of the Curve was to demonstrate that there is an optimum tax rate that would produce the highest level of tax revenues.)

Dr. Laffer postulated that the Fed, under Volcker, was instituting a policy guideline that was tied to changes in prices. If prices rose beyond a specific target, the Fed would raise the fed funds rate to slow the growth in the money supply; when prices fell below a specific target, the Fed would lower interest rates to provide more money to the economy. The mechanism used to target the Fed funds rate was the Dow Jones Spot Commodity Index�listed daily on the front page of the Wall Street Journal.

Dr. Laffer�s analysis appeared in the editorial page of the Wall Street Journal in October of 1982. During the balance of the Eighties, there was little discussion of this �price rule� guide for monetary policy. In wasn�t until late 1989 in an article entitled: �The Price Rule Vindicated,� that Dr. Laffer�s firm, Laffer Associates, tracked the relationship between the Dow Jones Spot Commodity Index, and the Fed funds rate. The study inferred that the Fed was operating on this price rule and that the success of this policy was reflected in declining inflation, falling interest rates, a growing economy, and a rising stock market. Of course, these favorable findings also coincided with dramatically falling oil prices from a 1980 high, as OPEC �broke� and lost effectiveness, an event that undoubtedly helped in the fight against inflation. Subsequent studies by Laffer Associates also demonstrated that the Fed continued on a price rule though the 1990s. Clearly, the Fed believed it had finally found the magic monetary wand that provided all of the benefits of stable prices.

Milton Friedman, the Nobel laureate in economics confirmed that something positive happened during this period. In a recent editorial in the Wall Street Journal he stated the following:

�The contrast between the periods before and after the middle of the 1980s is remarkable. Before, it is like a chart of the temperature in a room without a thermostat in a location with very variable climate; after, it is like the temperature in the same room but with a reasonably good though not perfect thermostat, and one that is set to a gradually declining temperature. Sometime around 1985, the Fed appears to have acquired the thermostat that it had been seeking the whole of its life.� Again, the collapse of oil prices did not factor into his reasoning.

Friedman goes on to explain how the Fed conducts monetary policy and influences the economy. He relies on the basic equation known as the quantity theory of money to explain the Fed�s problem in conducting monetary policy. Simply stated the equation is: The quantity of money (M) multiplied by the velocity or turnover of that money (V) = the price level (P) multiplied by output or GDP (y), MV=Py. Friedman states that, �to keep prices stable, the Fed must see to it that the quantity of money changes in such a way as to offset movements in velocity and output. Under a gold standard, (or other fixed exchange rate regime) the Fed influences this relationship by controlling the monetary base, the raw material (currency in circulation plus bank reserves) for the money supply, traditionally defined as bank deposits in one form or another.

Under the gold standard, the Fed manipulated reserves by buying and selling securities and paying for them with its own gold certificates to adjust available bank reserves. The banking system was reserve constrained by the finite amount of gold certificates available to meet demands for withdrawals. The direction of causation was from bank reserves to the economy. As Friedman stated: �Control over the base enables the Fed, if it chooses to do so, to control within narrow limits any one of a number of monetary aggregates�its control over these is absolute.� �

The power that Friedman conveys on the Fed is further expanded by his assessment that the Fed, through control of the base can �peg any number of interest rates, such as the Federal-fund rate or the three-month Treasury bill rate.� Accordingly, �it pegs the funds rate by open-market operations and, in the process, determining the rate of monetary growth.� However, in an open economy, interest rate differentials can cause gold to migrate from one country to another, posing it�s own set of monetary problems.

Who or What Determines the Money Supply?

The only problem with applying these relationships today is that we are not on a gold standard, as President Nixon suspended convertibility in 1971. Today banks are no longer reserve constrained since, with a nonconvertible currency; the government can lend actual cash to banks to meet withdrawal demands without the risk of loss of the nation�s gold supply. Depositors are free to switch from bank deposits to cash--substituting one asset for another--with no change in real wealth. When foreigners acquire dollars in exchange for goods, they have only two options to redeem those dollars. One option is to sell them for other currencies in foreign exchange market. The second option is to buy real goods and services at market prices. They can no longer go to the U.S. government to redeem them. �

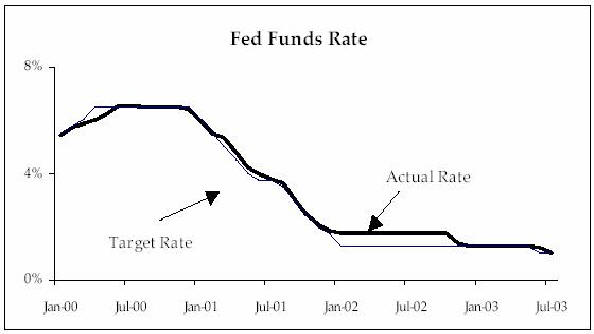

In a fiat currency world, causation runs from the economy to money supply, as loans create (insured) deposits, and deposits incur reserve requirements in the subsequent statement period. An unmet reserve requirement by a member bank is booked as an overdraft, which is in fact a loan from the Fed. This method of accounting means that, ultimately, the banking system is not reserve constrained, and that the Fed controls only interest rates in the sense that it is the �monopoly� supplier of the net reserves it requires of the banking system. As a result, the Fed does not directly control the supply of bank deposit money. To demonstrate this distinction, one only has to look at the behavior of interest rates and the growth in the monetary base. The Fed�s ability to control the Fed funds rate over the short-term is evident in Exhibit #1 that tracks the Fed�s systematic lowering of the Fed funds rate during the past three years.

Exhibit #1

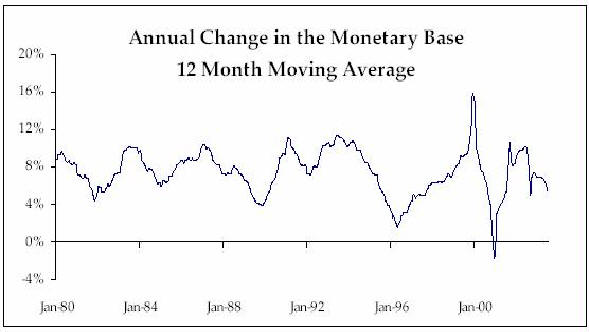

Data Courtesy of Federal Reserve Bank of St. Louis & Federal Reserve Bank of NYIn contrast to the stability in the Fed funds rate, the rate of growth in the monetary base has been much more volatile over various time periods (Exhibit #2 and #3).

Exhibit #2

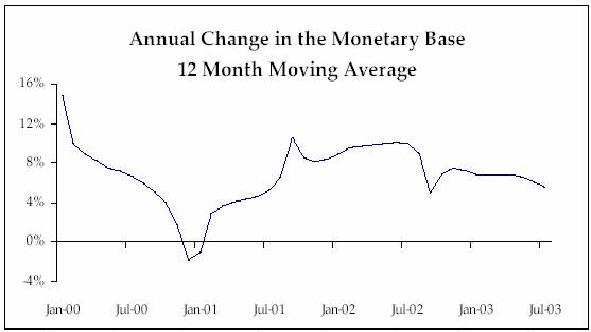

Data Courtesy of Federal Reserve Bank of St. LouisExhibit #3

Data Courtesy of Federal Reserve Bank of St. LouisThese data suggest that the Fed absolutely controls interest rates but can only indirectly influence changes in the monetary base. As previously discussed, monetary base growth or lack thereof is due to the fact that the quantity of required bank reserves is dictated by the willingness of banks to make loans. It is the economy via the banking system that is the independent variable, not the Fed�s attempts to control the monetary base. When the economy contracted in 2001 and the monetary base growth fell into negative territory in late 2000, the Fed could only continue to lower the Fed funds rate in hopes that lower interest rates would encourage businesses to borrow. After a sharp pop in the monetary base in mid 2001, there was little further growth in the monetary base even though the Fed continued to lower short-term interest rates through mid 2003.

The close relationship between the targeted Fed funds rate and the actual Fed funds rate reflects the Fed�s absolute control over these rates. On the other hand, the wide swings in growth rates of the monetary base reflect the fact that the economy, through shifts in loan demand at banks, is the factor determining changes in the monetary base.

Conclusions

When the U.S. went off the gold standard in 1971, monetary policy had to undergo a dramatic change. Before 1971, the Fed controlled bank reserves and the growth in the money supply was in theory constrained by gold�in the form of gold certificates at the Fed. After the abandonment of the gold standard in 1971 and the resulting fiat currency system, the Fed could only control interest rates as the mechanism to influence, but not determine the growth rate of the money supply. As a result of this change, economic activity and growth in loan demand ultimately determine the level of bank reserves and the growth in the money supply. The Fed�s role is to set the Fed fund�s rate as it accommodates bank loan demand by providing the reserves necessary to support that demand.

�*Thomas E. Nugent is Chief Investment Officer for PlanMember Financial Corporation in California.

Kudlow & Co. LLC

One Dag Hammarskjold Plaza

885 Second Avenue, 26th Floor

New York, New York 10017

212-644-8610 (p) 212-588-1636 (f)Lawrence Kudlow, CEO

Susan Varga, COO

John Park, Economic Associate

John Sullivan, Managing Director

James Higgins, Managing Director

Sam Munson, Research Associate�

posted 9-24-2003

�